MyArk DataWallet - the Apple Pay for data

Reduce onboarding abandonment and increase revenue

Your customers are making payments with one tap. We’ve built the one tap solution for digital forms - any application completed in seconds.

Businesses are losing up to 75% of hot leads due to form abandonment; we stop that. Reduce time to onboard by up to 90% by removing the need for manual form filling.

Easily convert customers

Cross sell

By harnessing deeper customer insights

Increase conversion

By reducing application abandonment

Engage & retain

By simplifying customer journeys

Easy to implement

Our APIs can be integrated in a couple of days

Autonomous

Data continuously updated so always live and accurate

GDPR compliant

All data is consent shared plus state of the art privacy

Explore our solutions

Web SDK & API

MyArk DataWizard

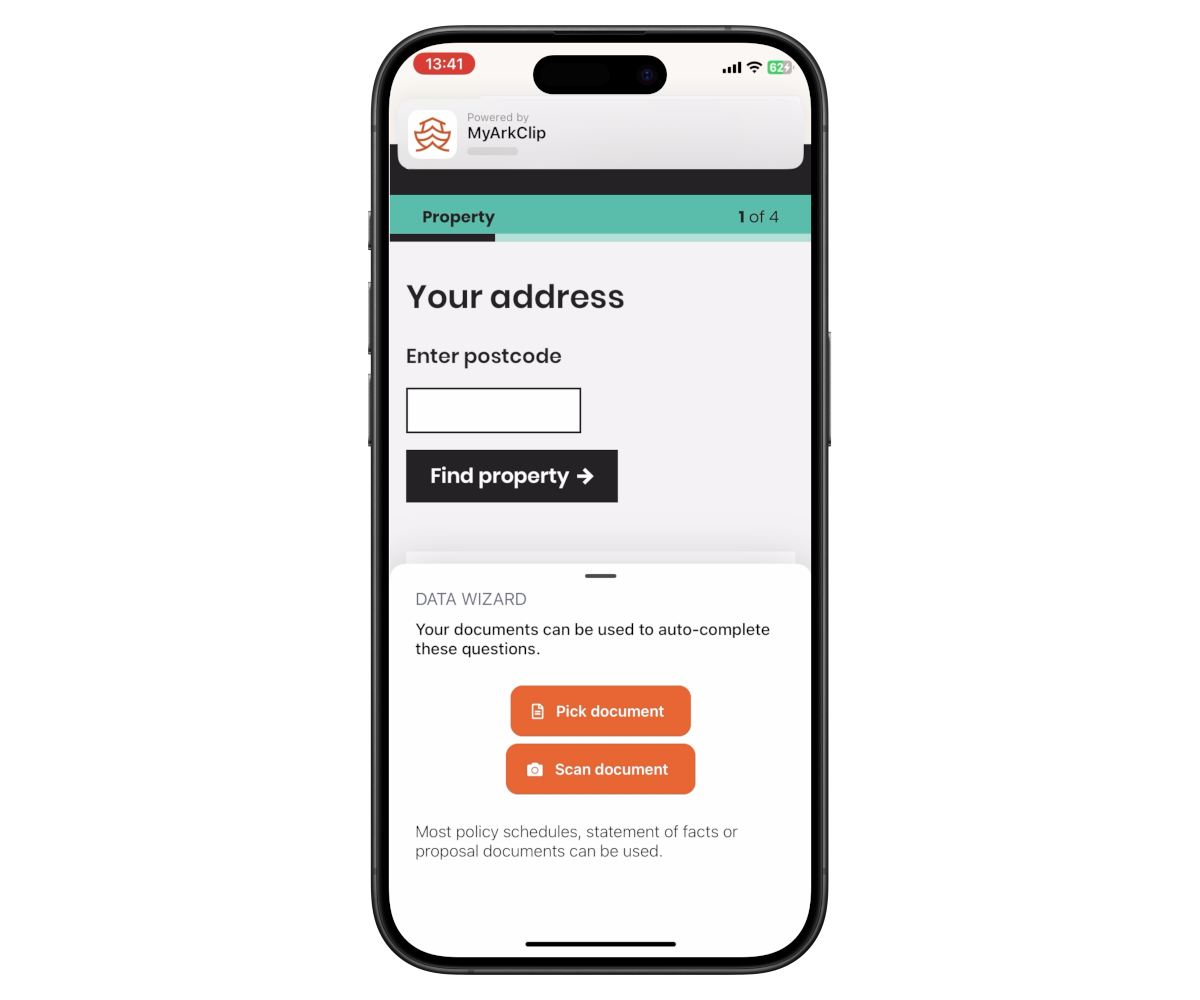

Embed MyArk API at point of frustration, for immediate pain relief

Scan/upload & read: Where MyArk API is embedded in your incumbent onboarding journey to read documents with our proprietary AI and auto-fill your existing form.

API

MyArk DataWallet

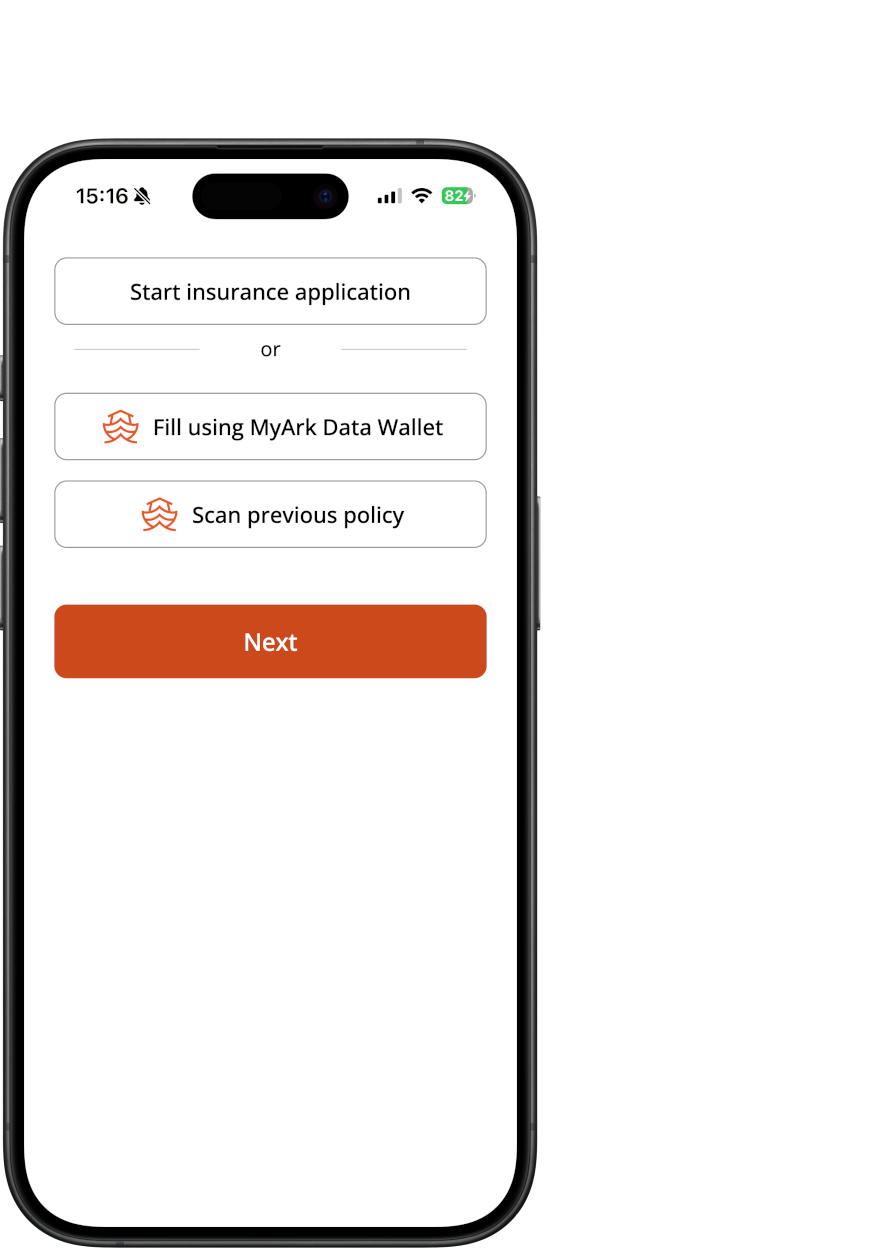

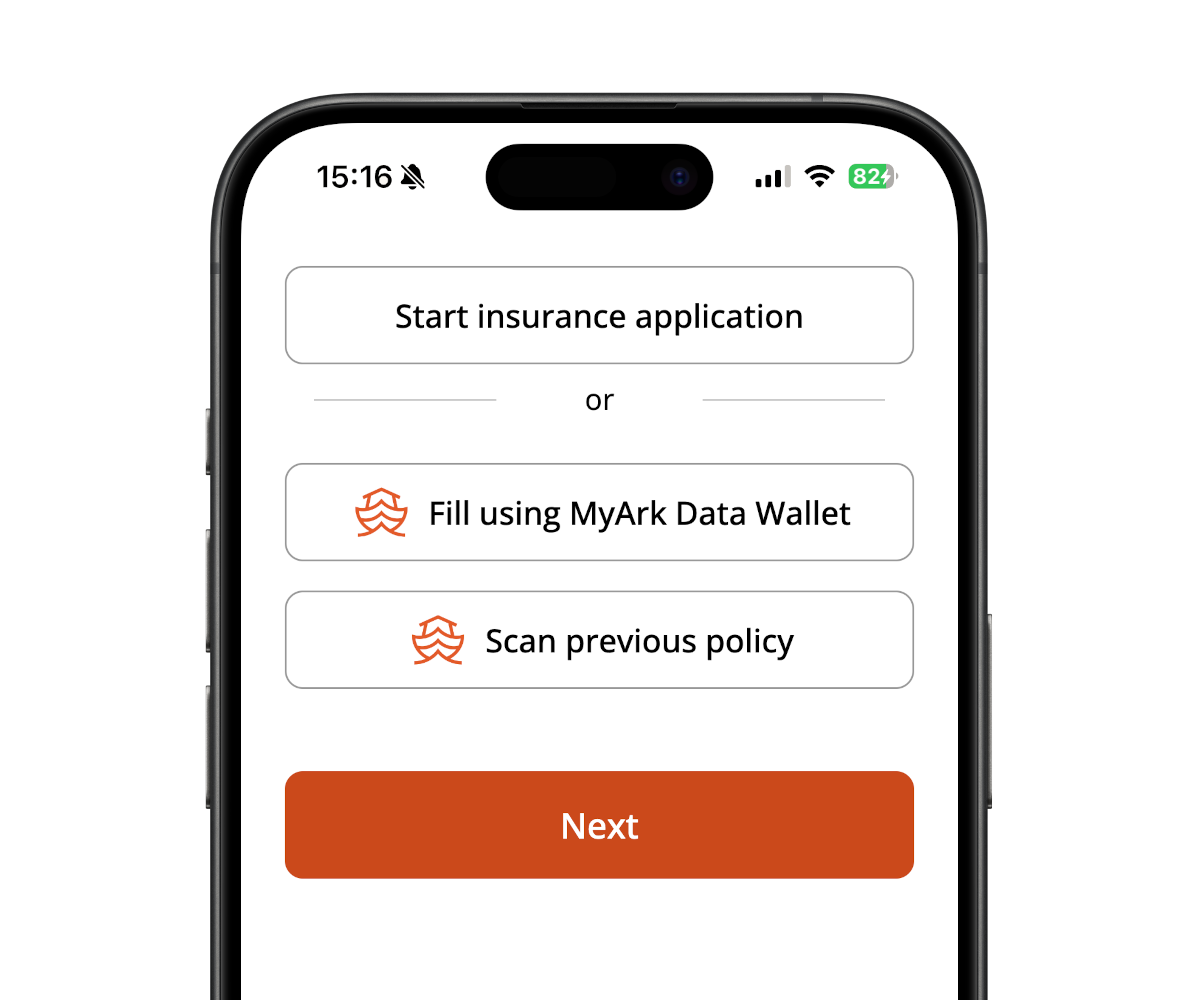

One tap solution

Enable the 'Fill with MyArk' option in your current onboarding journey to auto-fill forms from pre-stored data, for MyArk DataWallet users.

iOS app

Build data profile

Save data for later in the DataWallet app

Users can build their data profile from multiple sources including email, hard and soft copy documents, open banking, open APIs and sharing with other MyArk users.

iOS app and API

Generate hot leads

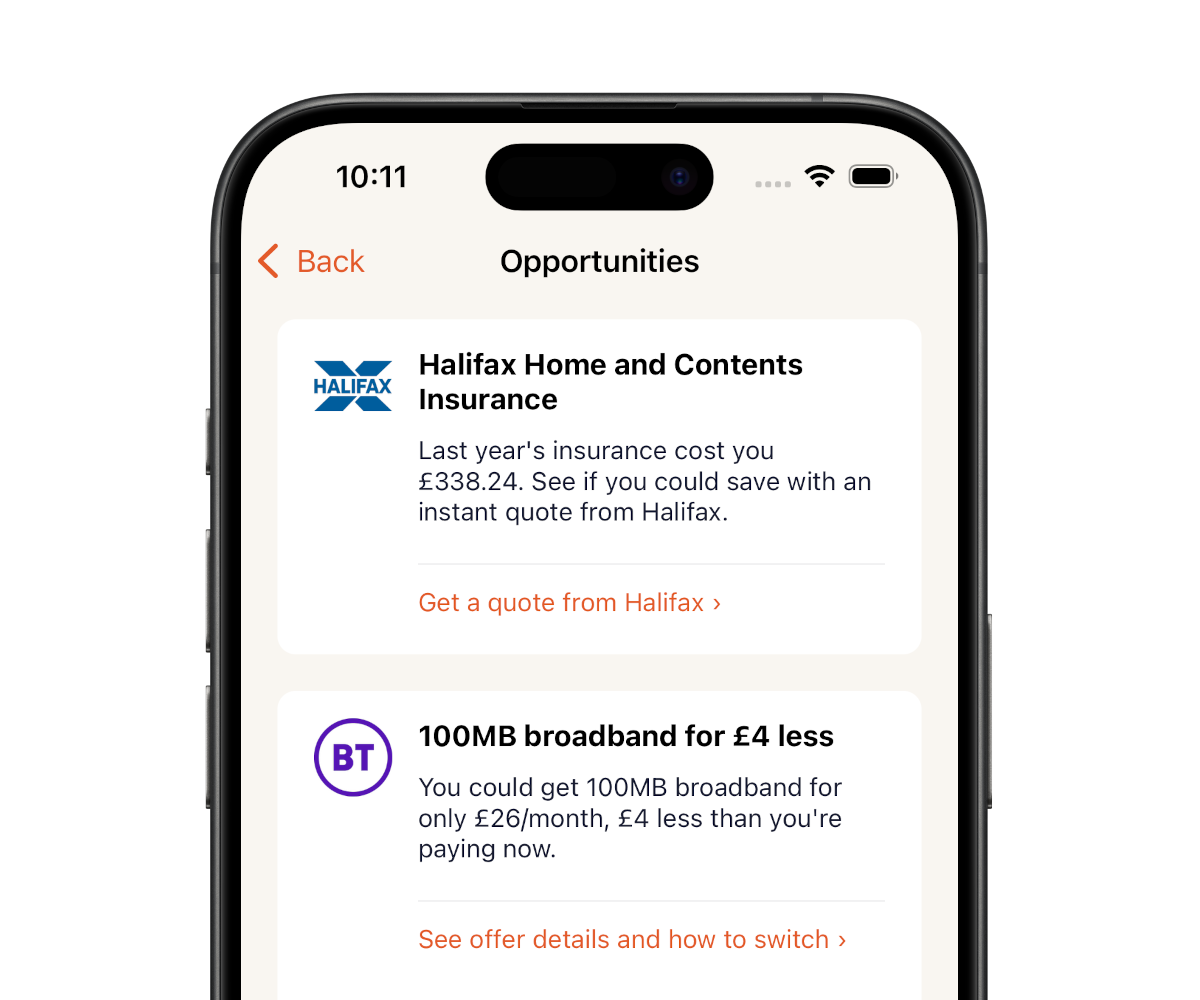

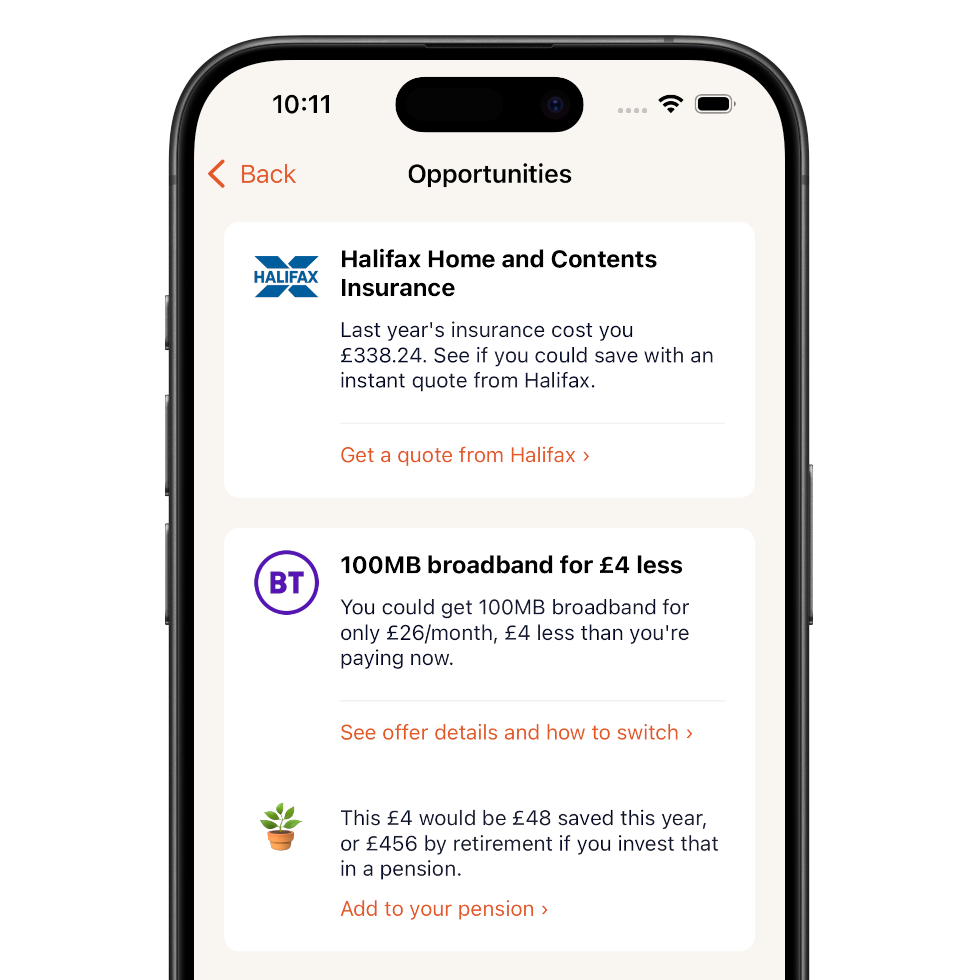

MyArk identifies pre-qualified opportunities

This enables rules-based identification of relevant products and services, generating a pre-qualified, hot leads.

With rules-based identification, offer products and services tailored to the individual. With consent, opportunities are flagged to your business and then data shared with just one tap.

One platform - endless use cases

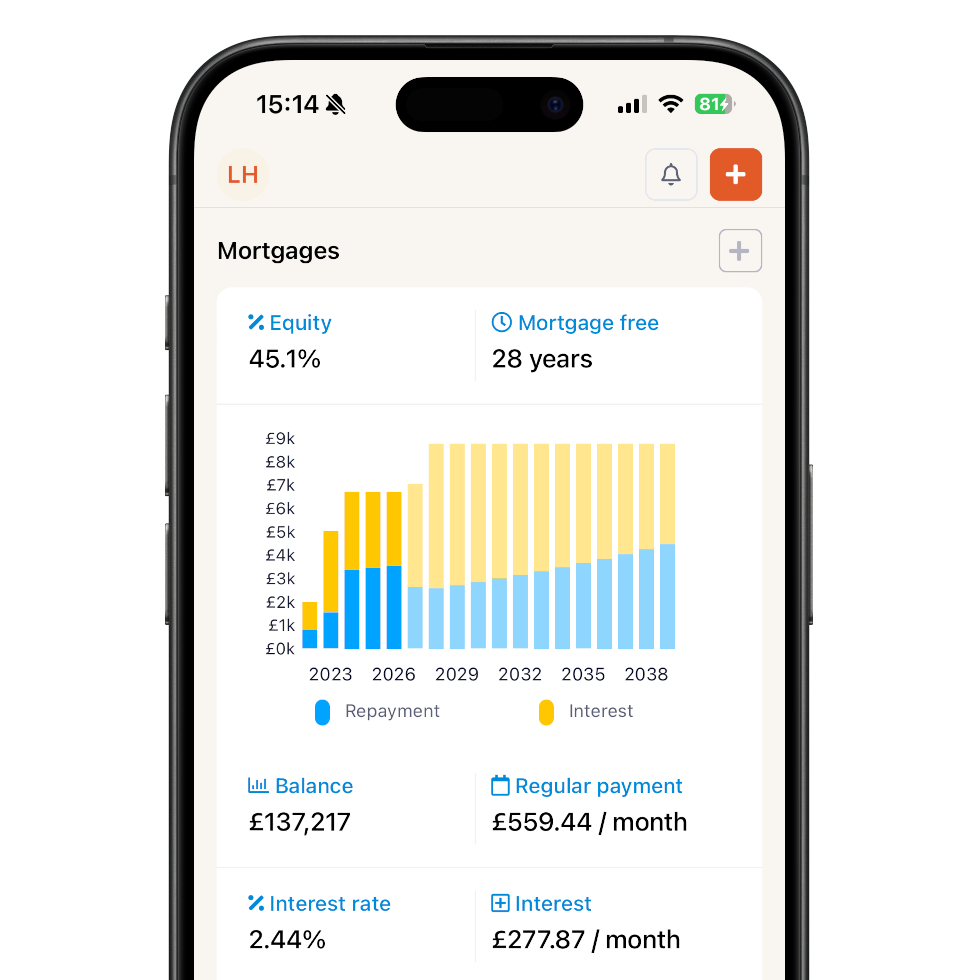

Mortgage

Reduce time spent on manually entering data into mortgage platforms – let MyArk do the heavy lifting for you by simply embedding the DataWizard API into your incumbent onboarding process.

Imagine if your customers could complete the fact-find in just one tap, so you can add value, not ask for their date of birth, from your first meeting.

Plus, seamlessly enable document upload, which can be pre-validated for date, readability and fraud detection. Offer the Data Wallet to your customers at zero cost to you.

Use your time to support customers, not chase documents.

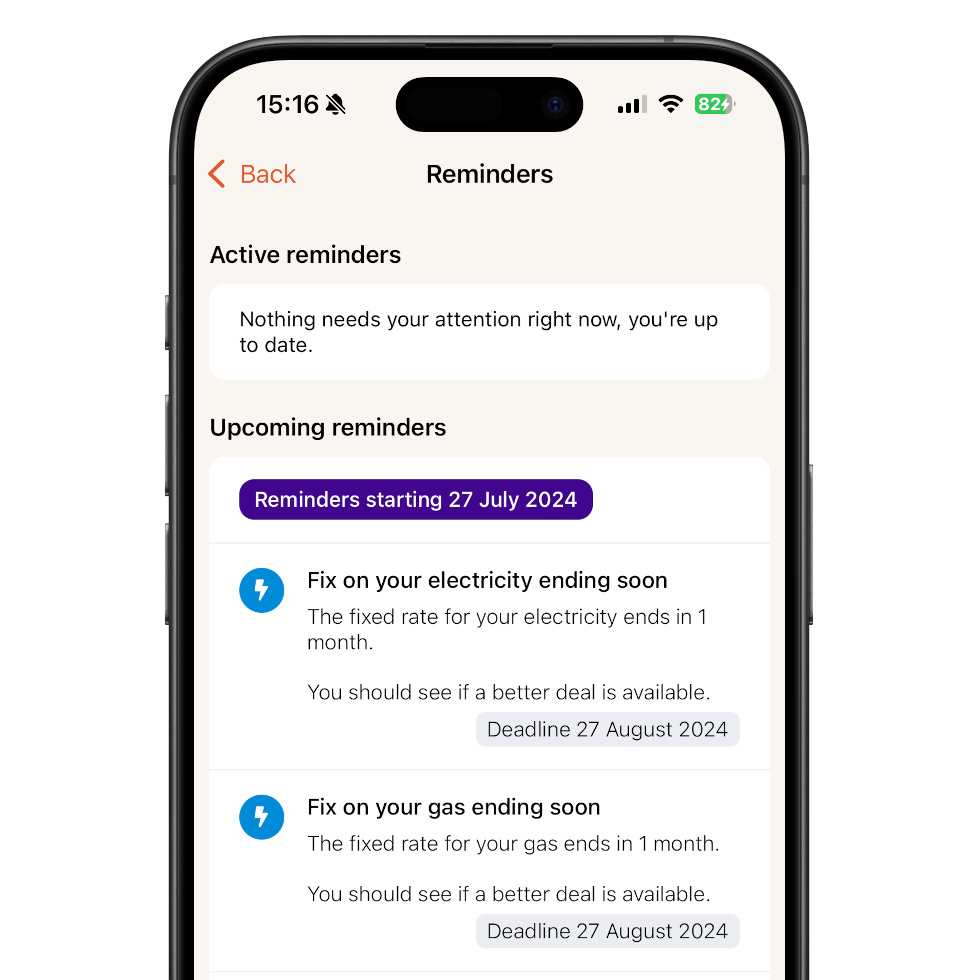

Bill switching

Onboarding forms that require manual data entry stop customers in their tracks and kills off conversion.

Accessing customer data at the next switch involves them re-keying everything yet again.

Embed the MyArk Data Wizard directly in your website or portal to enable a differentiated and seamless customer experience using our proprietary AI, to capture and extract relevant data to prepopulate onboarding flows, increasing conversation.

Plus offer the DataWallet to your customers for cross-sell opportunities, as a zero-cost benefit.

Insurance

Onboarding forms that require manual data entry can stop customers in their tracks and kill off conversion. Any form >100 secs can lose 50% of applicants.

But you need the data for compliance and underwriting. Shorter forms limit available data, affecting underwriting.

MyArk enables a differentiated and seamless customer experience, using our proprietary AI, to capture and extract relevant data. By simply scanning e.g. a previous policy MyArk Wizard then auto-fills the onboarding form.

Embed the MyArk Data Wizard directly in your website or portal, plus offer the DataWallet to your customer as a zero-cost benefit.

Banking

Abandonment for opening new accounts is up to 97%, and more than 70% for other online financial products.

New customer? Onboarding forms that require manual data entry can stop customers in their tracks and kill off conversion.

Current customer? Even worse – you ask them to fill in information they have already given you.

MyArk Data Wizard auto-fillings forms, increasing conversion and eradicating abandonment, with seamless API integration into incumbent processes.

Choose to also offer the DataWallet to support in Consumer Duty compliance. Proactively identify customer needs even if they aren't yet aware of them, additionally unlocking untapped revenue.

The Apple Pay for data

Eradicating abandonment

MyArk enables seamless data portability removing the friction of form filling and increasing conversion.

No more errors

Our proprietary AI is non-generative so is exceptionally accurate plus removes human error and omission.

Consent-driven sharing

Data is auto-filled via MyArk with end to end encryption, safely and securely plus GDPR compliant

Better data increases revenue

Reduce sales cycle time and increase win rate. No more unnecessary delays and sunk costs due to chasing customers for that extra document or piece of information.

Frequently asked questions

Absolutely - reach out to us and we’ll be in touch to organise a demo. You can also email us at hello@myark.io.

MyArk’s AI uses a hybrid approach that minimises the likelihood of AI haullicinations. After MyArk has seen a document type once, our AI creates a repeatable pattern that can be used to extract the data in a fraction of the time with guaranteed accuracy.

Our approach is different from the template-based approaches used by many document reading technologies, which would break frequently if the format of the document changes.

Our approach is different from large language models, where minor changes in a document can cause entirely different results and data might be made up entirely because of hallucinations.

The library of documents MyArk can read is constantly growing. For the document types in our library we provide 99% accuracy with just a few seconds of processing. If you need guaranteed accuracy levels for document types we might not have encountered before, then speak to us about human in the loop options that can achieve 99% accuracy even if we’ve never seen one like it.

MyArk DataWallet includes a set of APIs that provide a two-way link between your organisation and the data held by customers. For example, it allows you to:

- Set up the MyArk app with customer data before they’ve even signed in, by adding documents and details such as insurance and mortgages.

- Receive regular updates when a customer’s circumstances change, through our consent-driven sharing.

- Allow customers to own and hold their own data, minimising the risk to you, but making it easy for them to share data with you again when it’s necessary such as at renewal time.

MyArk’s APIs allow you to integrate MyArk’s products into your existing systems, for example:

- MyArk Data Wizard allows you to capture data from documents on your own website or onboarding portal. It includes a web SDK that can be used to scan documents accurately with a mobile phone camera, and APIs that allow you to receive the data extracted and the document as a PDF file.

- MyArk Data Link allows you to connect your existing systems (e.g. CRM, onboarding platform, or mortgage packaging) with the MyArk app (MyArk Retain). This allows customers to share data with you in just one tap and for you to provide them with documents without the need for your own customer portal.

Our APIs are all served securely and follow REST principles. We can provide detailed documentation, validation schemas, and hypermedia so your systems work reliably with MyArk and benefit from upgrades we make automatically.

MyArk DataWallet allows you to maintain a long-term relationship with your customers. When combined with MyArk Data Link, it connects your business and systems with MyArk’s native mobile app, allowing you to transfer all relevant data and documents both to and from your customers at the right time.

MyArk DataWallet uses multiple data sources to ensure data is never stale, including automatic discovery of information from emails, open banking for UK banks, open finance for pensions and investments, mobile phone scans for physical documents, and sharing with family and household that means you see the whole picture.

MyArk’s mobile app use the data to support your customers throughout life to optimise their financial health with personalised insights and guidance. When the time comes for renewal, our notifications and one-tap data sharing makes renewing easy and dramatically increases the likelihood that you’ll retain customers.

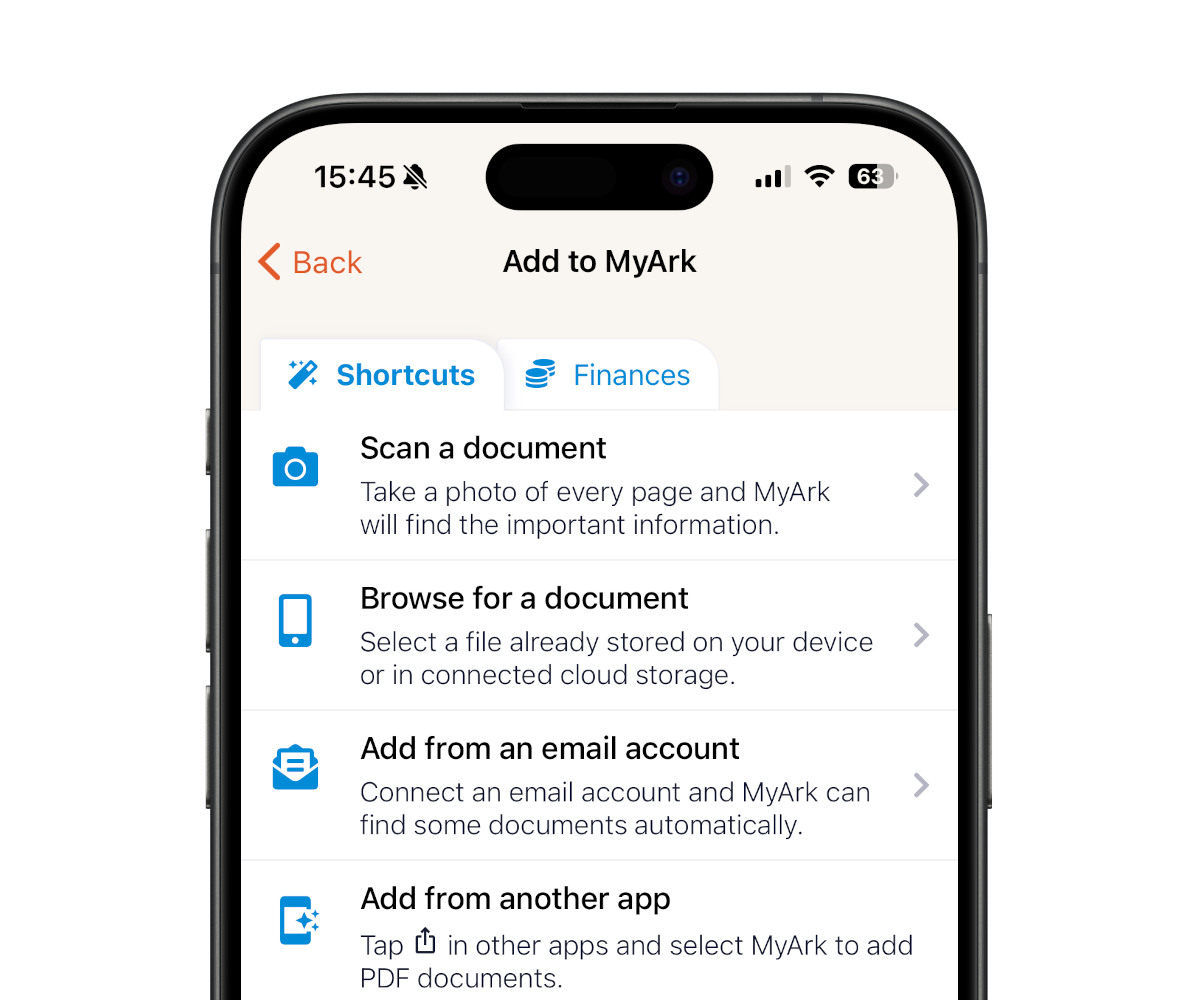

MyArk DataWizard allows you to prepopulate forms or capture data from your users with ease. MyArk Data Wizard allows data to be extracted from documents supplied in many different ways, including:

- Mobile phone scans, where our web SDK can automatically identify the edges of documents and guide users through the process of creating a high quality blur-free scan and provide you with multi-page searchable PDF files.

- Email forwarding, where our system can quickly find and extract data from both the email and its attachments and provide real-time updates to the user as data is extracted.

- Drag and drop, where information is extracted from image or PDF files, to provide a fast and familiar approach for desktop and tablet users.

- MyArk Data Wallet, where users can share the information held in the MyArk mobile app with you using just one tap. The MyArk app combines all of our technologies and data sources including email accounts and banking to ensure data is always fresh.

It’s provided as web components you can customise and embed in your own website using our SDK, such as for document scanning, and APIs that transfer the data to you securely in a structured and standardised data format using MyArk’s public-private data graph models.

We can work with you to make sure MyArk can read any type of document. We’re able to process some types of documents faster and more accurately than others though, for example structured and semi-structured documents including tax documents (e.g. UK HMRC P800 or P45), mortgage illustrations (which is semi-structured because of the European Standardised Information Sheet requirements), and energy statements.

MyArk’s AI already reads many types of document in just a few seconds with up to 99% accuracy, including the majority of these documents issued in the UK:

- Energy statements (gas and electric)

- Phone line and broadband bills

- Water and sewerage bills and statements

- Council tax bills

- Mortgage illustrations

- Mortgage statements

- Identity documents (passports and driving licences)

- Rental agreements

- Deposit protection certificates

For documents that are less standardised such as contracts, MyArk’s advanced language models can be used to identify and capture data. Talk to us to find out more.